__________ is a measure of the heterogeneity of observations in a classification tree.

A. Sensitivity

B. Specificity

C. Accuracy

D. Impurity

Answer: D

You might also like to view...

Glenn is trying to promote his new, self-published financial guidebook. By directly promoting it to readers in Wall Street Journal, he is using a push strategy.

Answer the following statement true (T) or false (F)

A calendar-year corporation has a $15,000 current E&P deficit and a $40,000 positive accumulated E&P balance. The shareholders of the corporation have a total basis in outstanding shares of $30,000. A $75,000 distribution is made to the shareholders on the last day of the year. The tax results to the shareholders will be

A) dividend income of $25,000, a tax-free return of capital of $30,000, and capital gain of $20,000. B) dividend income of $0, a tax-free return of capital of $30,000, and capital gain of $45,000. C) dividend income of $25,000, a tax-free return of capital of $5,000, and capital gain of $45,000. D) dividend income of $40,000, a tax-free return of capital of $30,000, and capital gain of $5,000.

The Dodd-Frank Reform Act does all of the following except:

A. reduces capital requirements for banks. B. increases transparency in the derivatives market C. limits the risk-taking in which banks can engage D. requires public companies to set "claw-back" provisions E. creates an office within the SEC to oversee credit rating agencies.

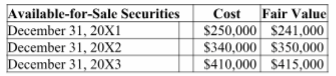

Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale securities. The year-end cost and fair values for its portfolio of these investments follow. The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X2 is:

A) Debit Unrealized Gain – Equity $10,000; Credit Fair Value Adjustment – Available-for-Sale (LT) $10,000.

B) Debit Fair Value Adjustment – Available-for-Sale (LT) $19,000; Credit Unrealized Loss –Equity $9,000; Credit Unrealized Gain – Equity, $10,000.

C) Debit Fair Value Adjustment – Available-for-Sale (LT) $10,000; Credit Unrealized Gain –Equity, $10,000.

D) Debit Fair Value Adjustment – Available-for-Sale (LT) $10,000; Credit Unrealized Loss –Equity $10,000.

E) Debit Fair Value Adjustment – Available-for-Sale (LT) $19,000; Credit Unrealized Gain –Equity $19,000.