About a half-million tort cases are filed each year

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

The Olympus case was unique from a corporate governance perspective because it deals with:

A. Cultural differences between U.S. and non-U.S. companies B. A board of directors that was completely under the influence of the CEO C. A company that consistently overrides its internal controls and commits fraud D. Cultural differences between Japanese management and western style of management

The voice system at an organization is easy to understand and uses simple procedures to resolve conflicts. Even though it takes a lot of time for employees to get their issues addressed, most employees believe that the system gives the right solutions to fix their issues. Which of the following statements is true about the voice system?

A. The voice system is responsive. B. The voice system lacks correctness. C. The voice system is elegant. D. The voice system is punitive.

Tomlison Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year: Cost of goods manufactured$1,589,000Cost of goods sold (unadjusted)$1,517,000 The journal entry to record the unadjusted Cost of Goods Sold is:

A.

| Finished Goods | 1,589,000 | ? | ? | |

| Cost of Goods Sold | 1,589,000 | |||

B.

| Cost of Goods Sold | 1,589,000 | ? | ? | |

| Finished Goods | 1,589,000 | |||

C.

| Finished Goods | 1,517,000 | ? | ? | |

| Cost of Goods Sold | 1,517,000 | |||

D.

| Cost of Goods Sold | 1,517,000 | ? | ? | |

| Finished Goods | 1,517,000 | |||

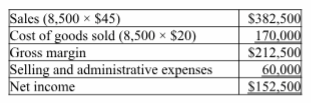

Production costs per leaf blower total $20, which consists of $16 in variable production costs and $4 in fixed production costs (based on the 10,000 units produced). Fifteen percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Wind Fall, a manufacturer of leaf blowers, began operations this year. During this year, the

company produced 10,000 leaf blowers and sold 8,500. At year-end, the company reported the following income statement using absorption costing:

A) $146,500

B) $158,500

C) $237,500

D) $206,500

E) $246,500