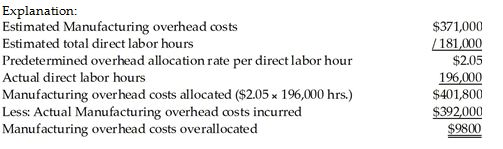

Lakeside, Inc. estimated manufacturing overhead costs for the year at $371,000, based on 181,000 estimated direct labor hours. Actual direct labor hours for the year totaled 196,000. The manufacturing overhead account contains debit entries totaling $392,000. The Manufacturing Overhead for the year was ________. (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $49,393 underallocated

B) $49,393 overallocated

C) $9800 underallocated

D) $9800 overallocated

D) $9800 overallocated

You might also like to view...

When McDonald's failed to realize that Applebee's and Chili's were providing products that met consumers' needs for a quick, tasty, and convenient meal, McDonald's failed to consider its ________

A) marketing mix B) mass customization C) direct competition D) indirect competition E) competitive advantage

What are cost objects? List examples of cost objects.

What will be an ideal response?

Prior to the adjusting process, accrued revenue has

A) been earned and cash received B) been earned and not recorded as revenue C) not been earned but recorded as revenue D) not been recorded as revenue but cash has been received

Which of the following is NOT one of the Seven Wastes?

A) overproduction B) transportation C) assignment D) defective product E) motion