N = 64 = 50 s = 16 H0: ? 54 Ha: ? < 54 The test statistic equals

a. -4

b. -3

c. -2

d. -1

C

You might also like to view...

With _______, supplier managers simply set their price in relation to what the competitors' prices are

The price may be set exactly the same as the predominant competitors, signaling commodity, or it may be slightly higher or lower because of perceived minor reputation, quality, or service differences. a. cost-plus pricing b. competition-based pricing c. value-based pricing d. skimming pricing

A strategic alliance is a

a. way to downsize. b. way for two companies to jointly contribute to the supply chain. c. packaged software. d. method of examining processes.

The Occupational Safety and Health Administration (OSHA) has proposed rules aimed at reducing repetitive-stress injuries. ATC, Inc disagrees with the proposed rules. If ATC, Inc wants to challenge the proposed rules, it must do so in court before the rules become final

Indicate whether the statement is true or false

Prepare a schedule of Realized and Unrealized Profits for 2017 for both companies. Show your figures before and after tax.

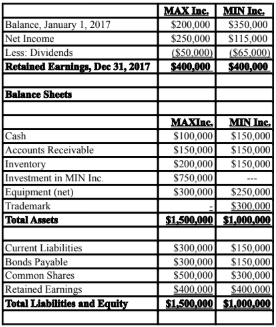

MAX Inc. purchased 80% of the voting shares of MIN Inc for $750,000 on January 1, 2015. On that date, MAX's common shares and retained earnings were valued at $300,000 and $150,000 respectively. Unless otherwise stated, assume that MAX uses the cost method to account for its investment in MIN Inc.

MIN's fair values approximated its carrying values with the following exceptions:

MIN's trademark had a fair value which was $80,000 higher than its carrying value.

MIN's bonds payable had a fair value which was $30,000 higher than their carrying value.

trademark had a useful life of exactly twenty years remaining from the date of acquisition. The bonds payable mature on January 1, 2035. Both companies use straight line amortization exclusively.

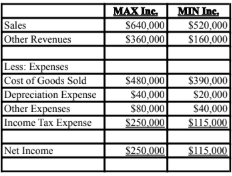

The financial statements of both companies for the year ended December 31, 2017 are shown below:

Income Statements

Retained Earnings Statements

Other Information:

A goodwill impairment test conducted during August 2017 revealed that the Min's goodwill amount on the date of acquisition had been impaired by $5,000.

During 2016, Max sold $60,000 worth of Inventory to Min, 80% of which was sold to outsiders during the year.

During 2017, Max sold inventory to Min for $80,000. 75% of this inventory was resold by Min to outside parties during that year.

During 2016, Min sold $40,000 worth of Inventory to Max, 80% of which was sold to outsiders during the year.

During 2017, Min sold inventory to Max for $50,000. 80% of this inventory was resold by Max to outside parties during that year.

All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 50%.

What will be an ideal response?