The short-run relationship between inflation and unemployment is often called as the Phillips curve.

Answer the following statement true (T) or false (F)

True

You might also like to view...

If the Fed buys a $100,000 government security from a bank when the desired reserve ratio is 10 percent and the currency drain ratio is 50 percent, the bank can loan a maximum of

A) $90,000. B) $100,000. C) $60,000. D) $40,000. E) $50,000.

A country with an overvalued currency

A. will have a balance of payments deficit. B. will suffer losses of foreign reserves. C. must intervene in the foreign-exchange market to buy its own currency. D. All of the above are correct.

Suppose that U.S. prices rise 4 percent over the next year while prices in Mexico rise 6 percent. According to the purchasing power parity theory of exchange rates, which of the following should happen?

A. The dollar will be worth 1.5 pesos in the foreign exchange market. B. The peso will be worth 1.5 dollars in the foreign exchange market. C. The dollar will depreciate. D. The peso will depreciate.

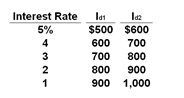

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.

Refer to the above table. Using the Id1 schedule, assume that the government needs to finance the public debt and this public borrowing increases the interest rate from 3% to 4%. How much crowding out of private investment will occur?

A. $100 billion

B. $200 billion

C. $600 billion

D. $700 billion