Which of the following is most likely to increase the incentive to invest, produce, and employ others?

a. an increase in government expenditures to provide subsidies for large banks that made bad investment decisions

b. an increase in government expenditures that changes the composition of aggregate demand

c. a reduction in tax rates

d. an increase in payments to unemployed workers financed by borrowing

C

You might also like to view...

Suppose that the equilibrium nominal interest rate is 5 percent and the equilibrium quantity of money is $1 trillion. At any interest rate below 5 percent,

A) the supply of money will decrease. B) there will be a surplus of money and bond prices will increase. C) the interest rate will fall and bond prices will fall. D) there will be a surplus of money and bond prices will fall. E) the interest rate will rise and bond prices will fall.

The long-run labor demand curve is relatively flatter than the short-run labor demand curve because, in the short run,

A) the wage rate is fixed. B) the firm cannot vary the amount of capital used. C) the firm is a price taker. D) All of the above.

The marginal benefit of acquiring additional information tends to

a. be zero if the marginal cost of information is zero b. increase and then decrease as additional information is obtained c. be smaller, the smaller the quantity of information the individual already has obtained d. increase as additional information is obtained e. decrease as additional information is obtained

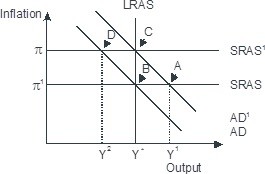

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C