What is his deduction under the following two circumstances?

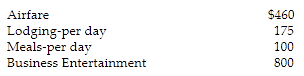

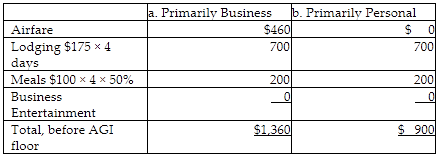

Richard, a self-employed business consultant, traveled from New Orleans to New York for both business and vacation. He spent 4 days conducting business and some days vacationing. He incurred the following expenses:

a. He spends three days on vacation, in addition to the business days.

b. He spends six days on vacation, in addition to the business days.

Note that the plane fare is not deductible because he spent more time on vacation than on business. Business entertainment is not deductible.

You might also like to view...

Which of the following is NOT a tool used to help manage marketing accountability?

A) optimization models B) planning C) interval scales D) CRM software E) forecasting

List the ways in which a sender can cultivate a "you attitude."

During a presentation, eye contact must be maintained with each person for at least 30 seconds

Indicate whether the statement is true or false

Common law refers to

a. law that is the same or similar in all the states. b. law made when judges decide cases and then follow those decisions in later cases. c. law made by legislatures in the form of statutes. d. the legal systems of France, Germany, and Italy.