Which of the following is not a reason for relief from the substantial understatement penalty?

A) disclosure of the relevant facts pertaining to the questionable tax return position

B) substantial authority for the tax return position

C) reliance on a tax return preparer

D) reasonable cause and a good faith effort to comply with the tax law

C) reliance on a tax return preparer

You might also like to view...

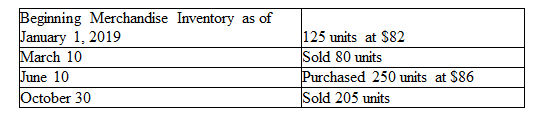

What would be reported as Cost of Goods Sold on the income statement for the year ending December 31, 2019 if the perpetual inventory system and the first-in, first-out inventory costing method are used?

Baldwin Company had the following balances and transactions during 2019:

A) $10,250

B) $17,450

C) $31,750

D) $24,010

Which of the following is true of service marketers?

A) They can always predict the consistency of service quality. B) They can typically offer customers a free trial of the service. C) They must identify ways of illustrating the benefits their service will provide. D) They typically market a service the same way a product would be marketed. E) They have no way to quantitatively measure service quality.

The following are examples of how organizational culture exerts behavioural control, except

A. culture generates unwritten standards of acceptable behaviour. B. culture encourages individual identification with the organization and its objectives. C. culture sets explicit boundaries. D. culture helps maintain control by creating behavioural norms.

On December 31, Strike Company has decided to sell one of its batting cages. The initial cost of the equipment was $215,000 with an accumulated depreciation of $185,000. Depreciation has been taken up to the end of the year. The company found a company that is willing to buy the equipment for $30,000. What is the amount of the gain or loss on this transaction?

A) Gain of $30,000 B) Loss of $30,000 C) No gain or loss D) Cannot be determined