Porter Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

What is the variable overhead efficiency variance? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

A) $1866 F

B) $1866 U

C) $2534 F

D) $2534 U

B) $1866 U

Explanation: Variable overhead efficiency variance = (Actual quantity - Standard quantity) × Standard cost

Variable overhead efficiency variance = (480 DLHr - 400 DLHr) × $23.33 per direct labor hour = $1866 Unfavorable

Note:

Standard quantity or standard direct labor hours for 4000 units = 4000 units × 0.1 direct labor hour per unit = 400 direct labor hours

Standard cost per direct labor hour = Budgeted variable overhead costs / Budgeted direct labor hours = $14,000 / 600 direct labor hours = $23.33 per direct labor hour

You might also like to view...

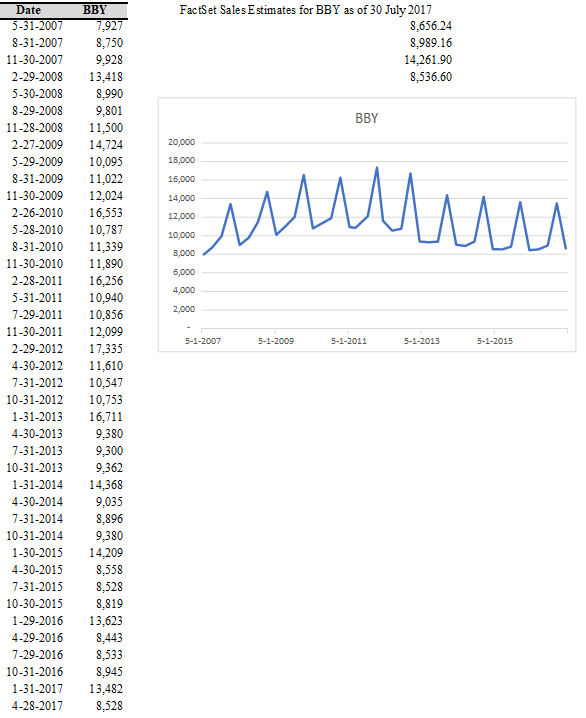

Using the Best Buy revenue data:

a) Fit the sales data using the Holt-Winters Multiplicative Seasonal model.

b) Find the optimal smoothing constants (?, ?, and ?) using the Solver. Set the Solver to minimize the MSE, and be sure to constrain the smoothing parameters to be between 0 and 1. What are the optimal values?

c) Using the model that you have created, forecast quarterly revenues for the next year.

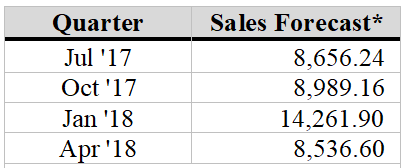

d) According to FactSet, analysts are forecasting the following revenues for the next year. How do your numbers compare?

Consumers usually know a good deal about ________ and are loyal to specific brands

A) specialty products B) unsought products C) impulse products D) MRO products E) emergency products

Under U.S. GAAP, Wheaton would record the following entry

a. Accumulated Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,000,000 Apartment Building (New Valuation) . . . . . . . . . . . . . . . . . . . .10,000,000 Loss on Impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,000,000 Apartment Building (Acquisition Cost) . . . . . . . . . . . . . . . . . . . . . . . . . 40,000,000 b. Accumulated Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000,000 Apartment Building (New Valuation) . . . . . . . . . . . . . . . . . . . .10,000,000 Loss on Impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000,000 Apartment Building (Acquisition Cost) . . . . . . . . . . . . . . . . . . . . . . . . . 40,000,000 c. Accumulated Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000,000 Apartment Building (New Valuation) . . . . . . . . . . . . . . . . . . . 11,000,000 Loss on Impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,000,000 Apartment Building (Acquisition Cost) . . . . . . . . . . . . . . . . . . . . . . . . . 40,000,000 d. Accumulated Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000,000 Apartment Building (New Valuation) . . . . . . . . . . . . . . . . . . . 12,000,000 Loss on Impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,000,000 Apartment Building (Acquisition Cost) . . . . . . . . . . . . . . . . . . . . . . . . . 40,000,000 e. Accumulated Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000,000 Apartment Building (New Valuation) . . . . . . . . . . . . . . . . . . . 12,200,000 Loss on Impairment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,800,000 Apartment Building (Acquisition Cost) . . . . . . . . . . . . . . . . . . . . . . . . . 40,000,000

Marketers find psychographics a valuable segmentation approach. What are some of the limitations of psychographic segmentation and what can marketers do to offset those limitations?

What will be an ideal response?