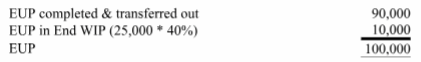

A company's beginning Work in Process inventory consisted of 20,000 units that were 80% complete with respect to direct labor. A total of 90,000 were finished during the period and 25,000 remaining in Work in Process inventory were 40% complete with respect to direct labor at the end of the period. Using the weighted-average method, the equivalent units of production with regard to direct labor were:

A) 46,000.

B) 100,000.

C) 76,000.

D) 90,000.

E) 116,000.

B) 100,000.

You might also like to view...

Second Chance is a paperback book exchange. For each book trade, the buyer pays a $1 trade fee. Books that are sold and not traded cost half of their original purchase price. The store has total assets of $126,000 and current assets of $40,200. Its net sales equaled $35,000, and its net profit after taxes was $9,000. Calculate the store's net profit percentage.

A. 25.7% B. 21.7% C. 22.4% D. 7.1% E. 27.7%

Sports Fit Company sponsors the "$100,000 Game" in which contestants compete in ten separate athletic events over a period of weeks. Sports Fit announces that the winner of each event will be awarded $5,000 with the "Ultimate Champion"?the winner of the most events?awarded $50,000 . If the "$100,000 Game" is treated as a unilateral contract, Sports Fit can

a. cancel the contest or alter its terms at any time. b. not modify the terms of the contest after it begins. c. reduce the amount of the event prizes but not the grand prize. d. reduce the amount of the grand prize but not the event prizes.

Acme, Inc., produces widgets. To manufacture a new type of widget, it took 30 hours for the first widget. Acme estimates it has a 95% learning rate. Using the logarithmic approach, calculate the time it will take to manufacture the eighth widget.

a. 25.71 hours b. 22.68 hours c. 19.62 hours d. 18.76 hours

Rebecca and Brad are married and will file jointly. Rebecca earns $300,000 from her single-member LLC (a law firm). She reports her business as a sole proprietorship. Wages paid by the law firm amount to $40,000; the law firm has no significant property. Brad is employed as a tax manager by a local CPA firm. Their modified taxable income is $381,400 (this is also their taxable income before the deduction for qualified business income). Determine their QBI deduction for 2019.

What will be an ideal response?