Assuming the free flow of capital, explain why the central bank of a country that has fixed its exchange rate would not find discussions of inflation on the agenda of its policy meetings.

What will be an ideal response?

As we saw in the chapter, a central bank must choose between a fixed exchange rate and an independent inflation policy; it cannot have both. So once a country or its central bank decides on a fixed exchange rate, then monetary policy has to be conducted so that its inflation rate matches the inflation rate of the country their currency is fixed with.

You might also like to view...

The stockholders of a corporation have ________ liability and ________ required to pay all of the firm's losses

A) limited; are B) limited; are not C) unlimited; are D) unlimited; are not

A decrease in Japanese real interest rates causes the dollar to _____________ which tends to _______________ U.S. Real GDP

A) appreciate; raise B) appreciate; lower C) depreciate; raise D) depreciate; lower

Investors tend to trade on their beliefs rather than on pure facts. This statement might explain why securities markets have ________ that the efficient market hypothesis does not predict.

a. such a large trading volume b. short sales c. a random walk d. arbitrage

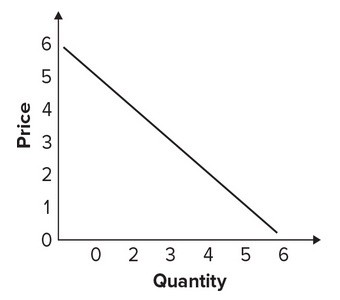

Given the graph, the quantity that would be associated with the price of $1 in a demand table would be:

A. 6. B. 5. C. 4. D. 3.