Which of the following is NOT part of Keynes's criticism of the classical theory of employment?

A. A reduction in wage rates will lead only to a reduction in total spending, not to an increase in employment.

B. Investment spending is not very strongly influenced by the rate of interest.

C. Prices and wages are simply not flexible downward in modern capitalistic economies.

D. Saving in modern economies depends largely upon the level of disposable income and is little influenced by the rate of interest.

B. Investment spending is not very strongly influenced by the rate of interest.

You might also like to view...

Suppose there are 10 apples and 10 oranges in the economy. Joe is currently consuming 4 apples and 5 oranges, and Jane is consuming 6 apples and 5 oranges

At this allocation, Joe's marginal utility of apples is 3, and his marginal utility of oranges is 5. Jane's marginal utility of apples is 6, and her marginal utility of oranges is 10. If the current price of apples is $4 and the current price of oranges is $5, then there is an: A) excess demand for apples and an excess supply of oranges. B) an excess demand for oranges and an excess supply of apples. C) equilibrium in the market with no excess supply or demand for either good. D) an excess supply of apples and oranges.

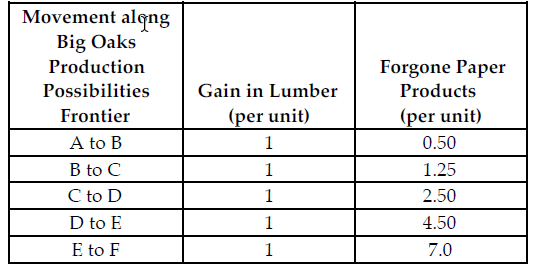

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is the marginal benefit for each unit of lumber produced?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $13.50

B) $16.50

C) $10.50

D) $3.00

If the underground economy is sizable, then GDP will:

a. accurately reflect this subterranean activity. b. overstate the economy's performance. c. understate the economy's performance. d. fluctuate unpredictably.

Does a state sales tax function as a progressive, regressive, or proportional source of revenue, and why?

What will be an ideal response?