Natalie sold a machine for $140,000. The machine originally cost $95,000 and $15,000 of MACRS depreciation had been allowable. The buyer assumed an existing loan of $40,000, paid $30,000 cash down and agreed to pay $10,000 per year for seven years plus interest. Selling expenses are $10,000. What is the amount of gain to be reported in the year of sale?

What will be an ideal response?

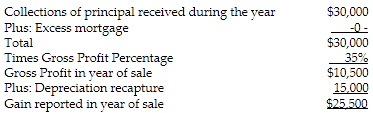

The selling price is $140,000. The gross profit from the sale is $35,000 ($140,000 - $80,000 adjusted basis - $10,000 selling expenses - $15,000 of depreciation recapture). The contract price is $140,000 - $40,000 loan = $100,000. The gross profit percentage is $35,000/$100,000 = 35%. The gain reported in the year of sale is:

You might also like to view...

________ is an electronic equivalent of word-of-mouth advertising.

A. Trendiness B. Viral marketing C. Sales promotion D. Ambush marketing

The sales budget for Modesto Corp. shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of Product B is 3,000 units. Total budgeted sales of both products for the year would be:

A. $464,000. B. $264,000. C. $500,000. D. $42,000. E. $200,000.

What is the right of a shareholder to permit another to vote her share called?

A) A convertible share B) A proxy right C) A voting right D) A preference right E) An election

In his job for Mickelson Associates, Alex has to report to two managers-the head of the accounting department and the head of the Southeastern Division. Mickelson Associates is a ________ organization.

A. process B. product C. matrix D. flat E. customer