Describe what use case modeling is

What will be an ideal response?

Use case modeling is a set of use cases that, when taken together, describe the behavior of a system. A use case is a unit of this model. It can also be defined as a contract between entities that have a stake in the outcome of a use case (i.e., stakeholders) and the system.

You might also like to view...

Researchers who support the RBC model found out that an RBC model could account for as much as _____ of the fluctuations in output growth.?

A. ?70 percent B. ?60 percent C. ?50 percent D. ?75 percent

Not all companies that use income segmentation target the affluent

Indicate whether the statement is true or false

Tough Steel, Inc. is a processor of carbon, aluminum, and stainless steel products. The firm is considering replacing an old stainless steel tube-making machine for a more cost-effective machine that can meet the firm’s quality standards. The old machine was acquired 2 years ago at an installed cost of $500,000. It has been depreciated under the MACRS’s 5-year recovery period, and has a remaining economic life of 5 years. It can be sold today for $350,000 before taxes, but if the firm decides to keep it, it can be sold for $100,000 before taxes at the end of year 5.

The first option is Machine A, which can be purchased for $600,000, but will require $30,000 in installation costs. This machine would be depreciated under the MACRS’s 3-year recovery period. At the end of its economic life, the machine will have a salvage value of $350,000 before taxes. This machine would require an investment in net working capital of $100,000.

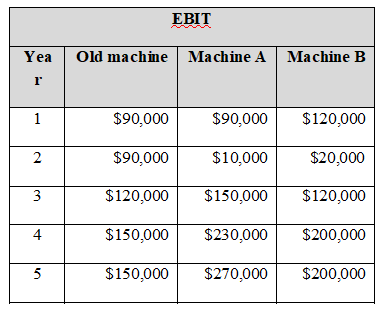

The second option is Machine B, which can be purchased for $550,000, but requires $20,000 in installation costs. This machine would be depreciated under the MACRS’s 5-year recovery period. At the end of its economic life, the machine would have a salvage value of $330,000 before taxes. This machine requires no investment in net working capital. The firm has estimated the following EBIT for all three machines:

a) Determine which machine is more profitable for the company based on the payback period, discounted payback period, net present value, profitability index, internal rate of return, and modified internal rate of return.

Aircraft makers Boeing and Airbus have a high degree of ________ because they make very similar products and have many buyers in common.

A. first mover advantages B. equity funding C. market commonality D. dynamic capabilities