The loss to society resulting from a tax includes the

A) deadweight loss.

B) consumer surplus paid to the government in the form of tax revenue.

C) producer surplus paid to the government in the form of tax revenue.

D) deadweight loss plus the consumer surplus and producer surplus paid to the government as tax revenue.

E) deadweight loss minus the tax revenue collected by the government.

A

You might also like to view...

One method that lenders use to mitigate the adverse selection problem is to

A) charge higher interest rates to less creditworthy borrowers. B) monitor closely the behavior of borrowers after a loan is made. C) ration credit. D) provide default insurance.

If the total cost of producing 2 pounds of cheese is $6 and the total cost of producing 4 pounds of cheese is $8, then:

a. marginal cost of producing cheese declines as output increases. b. average total cost of producing cheese declines as output increases. c. average total cost of producing cheese increases as output increases. d. average total cost remains constant irrespective of the change in output. e. marginal cost remains constant irrespective of the change in output.

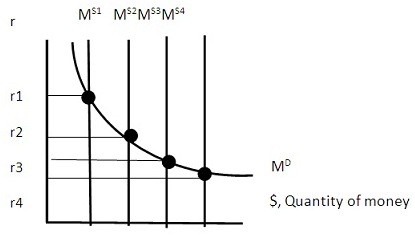

If the money supply in the economy were at MS2, and the Federal Reserve Bank used open market operations to move money supply to MS3, the overall direct result in the economy would be:

A. LRAS move to the FE level of output. B. Aggregate demand shifted in, causing GDP to fall. C. Aggregate demand shifted out, causing GDP to rise D. Aggregate supply shifted in, causing GDP to fall.

The supply curve for a perfectly competitive market:

A. is the summation of all the average cost curves of each firm in a market. B. is the summation of all the marginal cost curves, above the minimum of the average variable cost curve, from all the individual firms in the market. C. is not related to the supply curves of individual firms. D. is independent of price.