Smyrna Company had financial and taxable incomes as follows:

?

2016

2017

2018

Pretax financial income

$150,000

$140,000

$135,000

Taxable income

115,000

140,000

170,000

The tax rate for all three years was 30%.

?

Required:

a.Prepare the journal entries to record income taxes for all three years.b.Explain why the taxes paid in 2018 are different from the tax return and the amount reported in the financial statements and provide an example of what could cause this difference.

What will be an ideal response?

| a. | 2016 | ? | ? | |

| ? | Income Tax Expense ($150,000´.3) | 45,000 | ? | |

| ? | ? | Deferred Tax Liability ($35,000´.3) | ? | 10,500 |

| ? | ? | Income Taxes Payable ($115,000´.3) | ? | 34,500 |

| ? | ? | ? | ? | |

| ? | 2017 | ? | ? | |

| ? | Income Tax Expense ($140,000´.3) | 42,000 | ? | |

| ? | ? | Income Taxes Payable ($140,000´.3) | ? | 42,000 |

| ? | ? | ? | ? | |

| ? | 2018 | ? | ? | |

| ? | Income Tax Expense ($135,000´.3) | 40,500 | ? | |

| ? | Deferred Tax Liability ($35,000´.3) | 10,500 | ? | |

| ? | ? | Income Taxes Payable ($170,000´.3) | ? | 51,000 |

| ? | ? | |||

| b. | During 2016, there was an item that resulted in more financial income (pretax financial income on the income statement) than taxable income. This could have happened, for example, by using straight-line depreciation for financial purposes and MACRS for tax purposes. Therefore, in 2016, there was less tax paid than expense shown in the financial statements. As a result, when this item reversed, the impact was such that more taxes were paid in 2018. Due to the time value of money concept, Smyrna paid less real cash, although over time the accounting records balanced. | |||

You might also like to view...

Which input control check would detect a posting to the wrong customer account?

a. missing data check b. check digit c. reasonableness check d. validity check

Package delivery company UPS uses distinctive brown trucks that have become almost an icon. Explain why such physical facilities are important for UPS while it provides package delivery services

What will be an ideal response?

What is the balance of the company's Merchandise Inventory, as disclosed in the December 31, 2019 balance sheet as per the periodic FIFO inventory costing method?

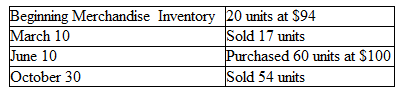

Samson Company had the following balances and transactions during 2019:

A) $564

B) $600

C) $1,880

D) $900

A buyer's resistance to a salesperson's product is usually caused by:

A) the salesperson failing to negotiate well B) another product satisfying the buyer's needs C) friends and acquaintances recommending the product D) the product's advanced stage in the product life cycle E) the product's price being equal to the buyer's current product