The law will carefully scrutinize contracts between Pete, a trustee, and Mason, a beneficiary of the trust, to make sure there was no undue influence by Pete

a. True

b. False

Indicate whether the statement is true or false

True

You might also like to view...

More accurate and descriptive terms for podcasting are ________ for audio content and vcasting for video content

Fill in the blank(s) with correct word

Nutrition, Inc, a vitamin supplement manufacturer, is financed entirely with equity that is currently privately owned by its managers

The firm is expected to generate earnings of $5 million per year into perpetuity, and all earnings are paid out in dividends. The owner-managers receive no additional compensation. For all of the owner-managers, their shares of the firm's equity account for the bulk of their personal wealth. As a result, in determining their personal valuation of the firm they apply a high discount rate of 33% to their future expected dividends, and thus they value the firm at $15.15 mn. (=$5 mn./0.33). The management team has recently consulted with an investment-banking firm about selling all of the firm's equity publicly; that is, about going public with the firm's shares. Assuming that the current management will continue to operate the firm, the investment banker estimates that the market will value the firm's equity by applying a 25% discount rate to expected future dividends. However, expected dividends to public shareholders will be only $4 mn., because managers will now be paid a total of $1 mn. per year in salaries. Ignoring taxes and transaction costs: the market value of the firm's public shares is (i); the present value of management's salaries (discounted at 33% into perpetuity) is (ii) ; and therefore the management team's wealth gain (or loss) from going public is (iii). (i) (ii) (iii) a. $12 mn. $3.03 mn. -$0.12 mn. b. $16 mn. $3.03 mn. $4.12 mn. c. $16 mn. $4 mn. $4.85 mn. d. $12 mn. $4 mn. $0.85 mn.

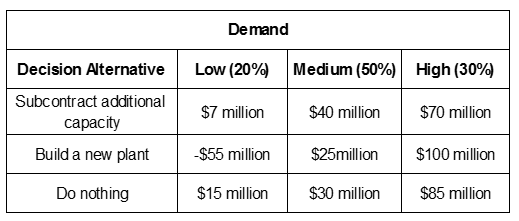

XYZ is a paint product manufacturer, and one of the plants is experiencing a substantial increase in demand. The future demand for the products could be low, medium, or high, with probabilities estimated to be 25%, 50%, and 30%, respectively. The company wants to determine the financial impact associated with the three decision alternatives under the varying levels of demand. Given the following payoff matrix, compute the expected regret for the option of subcontracting additional capacity.

A. $10.6 million

B. $21.5 million

C. $9.5 million

D. $14 million

Inhibitors to marketing research include all of the following except

a. cost. b. irrelevancy. c. complexity. d. distribution.