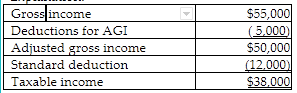

In 2018, Sean, who is single and age 44, received $55,000 of gross income and had $5,000 of deductions for AGI and $5,600 of itemized deductions. Sean's taxable income is

A) $38,000.

B) $43,000.

C) $44,400.

D) None of the above.

A) $38,000.

You might also like to view...

Pace Corporation acquired 100 percent of Spin Company's common stock on January 1, 20X9. Balance sheet data for the two companies immediately following the acquisition follows:ItemPaceCorporationSpinCompanyCash $30,000 $25,000 Accounts Receivable 80,000 40,000 Inventory 150,000 55,000 Land 65,000 40,000 Buildings and Equipment 260,000 160,000 Less: Accumulated Depreciation (120,000) (50,000) Investment in Spin Company Stock 150,000 Total Assets $615,000 $270,000 Accounts Payable $45,000 $33,000 Taxes Payable 20,000 8,000 Bonds Payable 200,000 100,000 Common Stock 50,000 20,000 Retained Earnings 300,000 109,000 Total Liabilities and

Stockholders' Equity $615,000 $270,000 At the date of the business combination, the book values of Spin's net assets and liabilities approximated fair value except for inventory, which had a fair value of $60,000, and land, which had a fair value of $50,000. The fair value of land for Pace Corporation was estimated at $80,000 immediately prior to the acquisition.Based on the preceding information, what is the differential associated with the acquisition? A. $21,000 B. $6,000 C. $10,000 D. $15,000

Wholesale markets for retail buyers include only annual trade shows.

Answer the following statement true (T) or false (F)

According to the text, what is the single most important factor in improving the climate for ethical behavior in a sales force?

A. Quick disciplinary action against offenders B. The actions taken by top management C. Effective goal-setting programs D. The development of ethics training seminars E. The establishment of whistle-blowing procedures

What are some of the things that you should keep in mind when you receive criticism?

What will be an ideal response?