An employee earned $4,600 in February working for an employer. Cumulative earnings of the previous pay periods are $4,800. The FICA tax rate for Social Security is 6.2% of the first $128,400 of earnings each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The current FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. What is the amount the employer should record as payroll taxes expense for the month of February?

A. $351.90

B. $110.00

C. $483.90

D. $230.00

E. $581.90

Answer: C

You might also like to view...

Why are good communication plans essential?

a. It encourages people to conquer their fear of public speaking b. It is easy to convince employees that they’ve been heard, so it’s a big return on an investment c. Most everyone in the organization has the same general idea of the change but needs additional details d. It minimizes rumors and helps mobilize support

What are the techniques that can be used to overcome people's natural resistance to price?

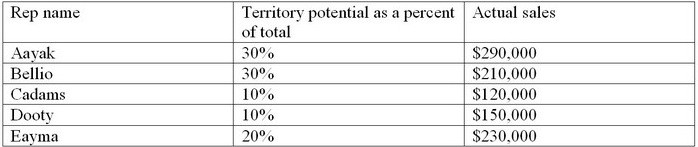

Information about five sales reps and their territories is presented below. If the firm has total sales of $1 million, which sales rep has the highest performance index?

A. Eayma B. Dooty C. Bellio D. Cadams E. Aayak

______ is an orientation that puts others ahead of the self.

A. Compassion B. Transcendence C. Integrity D. Self-awareness