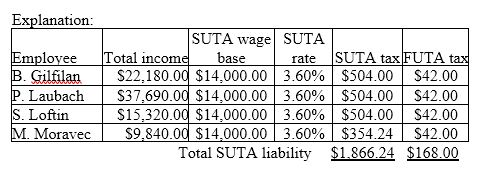

Dena's Decorations is a South Carolina business that has a SUTA rate of 3.6% and an annual SUTA wage base of $14,000. The employee earnings for the past calendar year are: B. Gilfilan $22,180, P. Laubach $37,690, S. Loftin $15,320, M. Moravec $9,840.

What are the FUTA and SUTA tax liabilities for Dena's Decorations?

A) FUTA $1,686.20; SUTA $168

B) FUTA $168; SUTA $1,866.24

C) FUTA $1,686.20; SUTA $531.36

D) FUTA $531.36; SUTA $2,102.58

B) FUTA $168; SUTA $1,866.24

You might also like to view...

Telling readers where to find information on an unfamiliar system can be considered which of the following compositional modes?

A) Narrative B) Reference materials C) Summaries D) Orientations E) Conversations

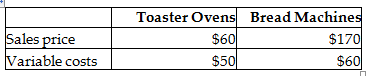

Boylan can manufacture six toaster ovens per machine hour and four bread machines per machine hour. Boylan's production capacity is 1600 machine hours per month. Marketing limitations indicate that Boylan can sell a maximum of 6000 toasters and 4100 bread machines per month. Which product and how many units should the company produce in a month to maximize profits? (Round machine hour per unit to two decimal places and your final answer to the nearest whole dollar.)

Boylan Company manufactures two products—toaster ovens and bread machines. The following data are available:

A) 6400 bread machines

B) 3450 toaster ovens and 4100 bread machines

C) 6000 toaster ovens and 2400 bread machines

D) 9600 toaster ovens

The cost object under the control of a manager is called a(n) ____ center

a. cost b. revenue c. responsibility d. investment

____________ is a useful sales forecasting method as long as a precise relationship between past sales figures and one or more variables can be established. Without these relationships, this method is useless in forecasting future sales.

A. Trend analysis B. Random factor analysis C. Delphi technique D. Cycle analysis E. Regression analysis