Which of the following distributions approximate Kruskal-Wallis test statistic H when the problem objective is to compare k populations (k > 2) where the sample sizes are greater than or equal to 5?

a. normal distribution

b. chi-squared distribution

c. Student t-distribution

d. None of these choices.

B

You might also like to view...

Most products can be offered with varying ________ that can supplement its basic function

A) degrees of reliability B) conformance qualities C) features D) forms E) designs

Which of the following is an advantage of online communications for marketers?

A) Consumers cannot effectively screen out your messages. B) Companies can accurately track how effective their ads are because software filters out all bogus hits. C) Companies can offer tailored information or messages that engage consumers. D) Advertisers maintain complete control over the message. E) Advertisers do not need to worry as much about context.

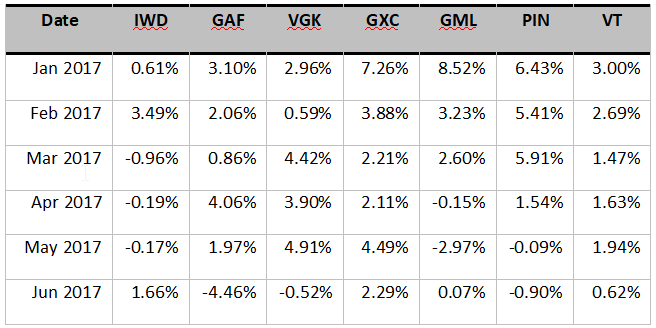

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchange-traded funds (ETFs) that invest in equity market indices of several world regions, including a world equity index, in an attempt to evaluate a well-diversified international portfolio. The regions you have selected are the following: Latin America (GML), Middle East & Africa (GAF), Europe (VGK), China (GXC), India (PIN), U.S. (IWD), and the entire world (VT). You have gathered the monthly returns of these ETFs from January to June 2017. The returns are in the following table:

a) Determine the average returns and standard deviations of each ETF. Also, determine the correlation coefficient and covariance of the American ETF (IWD) with the other ETFs of the rest of the world.

b) Determine the best and worst performer on a risk/return basis during this period. Use the Sharp ratio and assume that the relevant risk-free rate was 3%.

c) What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs except VT (world index ETF)? Are these results similar to those of VT?

d) Using the Solver, what is the minimum standard deviation that could be achieved by combining these ETFs into a portfolio, with the exception of VT? What are the exact weights of these ETFs? Assume short sales are not allowed.

Allowance for Doubtful Accounts is a liability account

Indicate whether the statement is true or false