The current portion of long-term notes payable is ________.

A) the amount of principal that will be paid within five years

B) typically included with the long-term liabilities on the balance sheet

C) recorded as an adjusting entry

D) reclassified as current for reporting purposes on the balance sheet

D) reclassified as current for reporting purposes on the balance sheet

You might also like to view...

Airlines overfill customers beyond their seating capacity in order to compensate for customers who cancel their booking. This technique is an illustration of which of the following yield management strategies?

A. overbooking B. adjusting prices to augment demand C. annualized hours strategy D. using different fare classes to partition demand

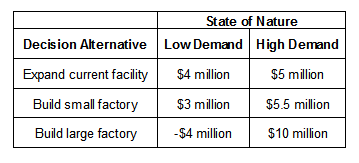

ABC operates a factory in the United Kingdom. Because the company’s existing factory doesn’t have the capacity to meet the future demands, it is considering various options. Consider the payoff matrix that shows the payoff for each combination of decision and state of nature. Determine the best alternative using the Hurwicz criterion. Assume ? = 0.7.

a. Expand current facility.

b. Build small factory.

c. Build large factory.

d. Determine a new alternative.

On July 1, Shady Creek Resort borrowed $250,000 cash by signing a 10-year, 8% installment note requiring equal payments each June 30 of $37,258. What is the appropriate journal entry to record the issuance of the note?

A. Debit Notes Payable $250,000; credit Cash $250,000. B. Debit Cash $287,258; credit Interest Payable $37,258; credit Notes Payable $250,000. C. Debit Cash $250,000; debit Interest Expense $37,258; credit Notes Payable $287,258. D. Debit Cash $37,258; credit Notes Payable $37,258. E. Debit Cash $250,000; credit Notes Payable $250,000.

When a company is obligated for sales taxes payable, it is reported as a(n):

A. Business expense. B. Current liability. C. Long-term liability. D. Contingent liability. E. Estimated liability.