Winters Corporation purchased 15,000 shares of Poores Corporation common stock for $60 per share on January 2, 2014. Poores Corporation reported net income of $1,500,000 for 2014 and paid dividends of $300,000 during 2014. Poores has a total of 50,000 shares of common stock outstanding. The entry that would be recorded to recognize the income is:

A) Cash 90,000 Dividend Income 90,000

B) Investment in Poores Corporation 450,000 Income, Poores Corporation Investment 450,000

C) Dividend Income 450,000 Cash 450,000

D) Investment in Poores Corporation 450,000 Cash 450,000

B

You might also like to view...

Tangible benefits are those that can be reasonably quantified, such as reduced equipment costs and increased revenues

Indicate whether the statement is true or false

The Swatch Group is the world's second largest watchmaker. This shows that in the low-cost segment, brands compete on price and value

Indicate whether the statement is true or false

Defusing a situation with a customer by acknowledgment can be used in every unhappy situation with any customer.

Answer the following statement true (T) or false (F)

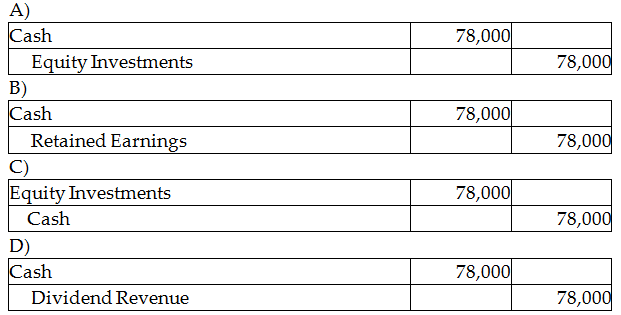

Gaines Corporation invested $114,000 to acquire 24,000 shares of Owens Technologies, Inc. on March 1, 2018. On July 2, 2019, Owens pays a cash dividend of $3.25 per share. The investment is classified as equity securities with no significant influence. Which of the following is the correct journal entry to record the transaction on July 2, 2019?