Solve the problem.You want to have a  college fund in 20 years. How much will you have to deposit now in an account with an APR of 5% and daily compounding?

college fund in 20 years. How much will you have to deposit now in an account with an APR of 5% and daily compounding?

A. $35,950.49

B. $36,790.46

C. $36.794.39

D. $38,940.29

Answer: B

You might also like to view...

Decide whether the statement makes sense. Explain your reasoning.I am young and I am looking for high-return investments even if that means higher risk. That's why I am putting most of my money into stocks.

What will be an ideal response?

Answer the question.You must decide whether to buy a new car for $26,000 or lease the same car over a three-year period. Under the terms of the lease, you make a down payment of $1600 and have monthly payments of $320. At the end of three years, the leased car has a residual value (the amount you pay if you choose to buy the car at the end of the lease period) of $15,000. Assume you sell the new car at the end of three years at the same residual value. Compare the cost of leasing and buying the car.

A. Buy $11,000, lease $13,420 B. Buy $12,000, lease $13,120 C. Buy $11,000, lease $12,820 D. Buy $11,000, lease $13,120

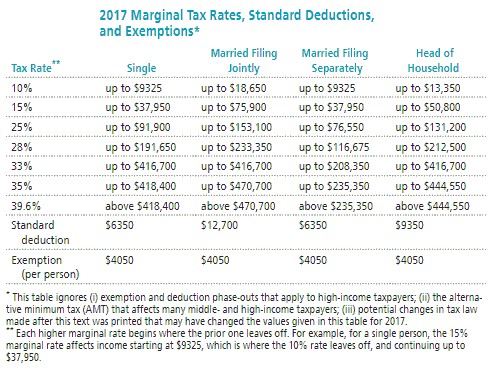

Solve the problem. Refer to the table if necessary. Jeff earned wages of

Jeff earned wages of  received

received  in interest from a savings account, and contributed

in interest from a savings account, and contributed  to a tax deferred retirement plan. He was entitled to a personal exemption of

to a tax deferred retirement plan. He was entitled to a personal exemption of

style="vertical-align: -4.0px;" /> and had deductions totaling  Find his taxable income.

Find his taxable income.

A. $46,588

B. $57,740

C. $38,488

D. $65,418

Explain how the factors in a present value of an ordinary annuity table are converted into the factors in a present value of an annuity due table.

What will be an ideal response?