The FASB addressed simultaneous financing and investing activities by requiring they be:

A. reported separately on a supplemental schedule to the cash flow statement.

B. reported separately on the income statement.

C. ignored.

D. reported on the retained earnings statement.

Answer: A

You might also like to view...

[APPENDIX] A decrease in deferred taxes (liability) would appear on the statement of cash flows, prepared using the indirect method as a(n)

a. addition to net income in the operating activities category. b. deduction to net income in the operating activities category. c. inflow of cash in the financing activities category. d. outflow of cash in the financing activities category.

What can be surmised from the existence of the Sarbanes-Oxley Act?

a. There are sometimes legal requirements with respect to having a code of ethics. b. Companies without codes of ethics are bound to violate the law. c. Federal law requires that every company have a written code of ethics. d. The federal government has dictated the content of codes of ethics for many companies.

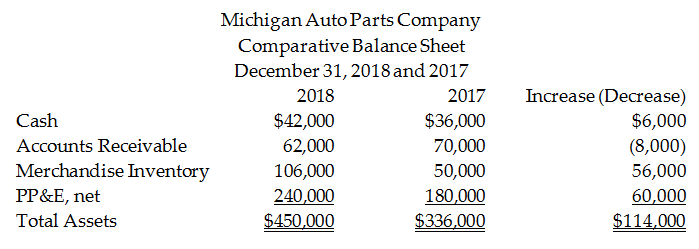

Prepare the investing activities section of the statement of cash flows.

Michigan Auto Parts Company uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net book value of $20,000 was sold for $28,000.

Depreciation expense of $24,000 was recorded during the year.

Identify and describe the four organizational culture values that appear to be important in most cultures.

What will be an ideal response?