If the government decides to levy an ad valorem tax on product with a perfectly inelastic supply. The consumers tax incidence will be

A) 0

B) 1

C) .5

D) Cannot be determined.

A

You might also like to view...

For a given level of equilibrium GDP, a tight-money/easy-fiscal policy mix compared with easy-money/tight-fiscal policy mix implies a

A) lower interest rate. B) lower level of investment. C) higher level of taxation. D) lower level of government expenditures.

Refer to Figure 3-13. Suppose Peru decides to increase its production of emeralds by 2. What is the opportunity cost of this decision?

a. 30 rubies b. 40 rubies c. 60 rubies d. 120 rubies

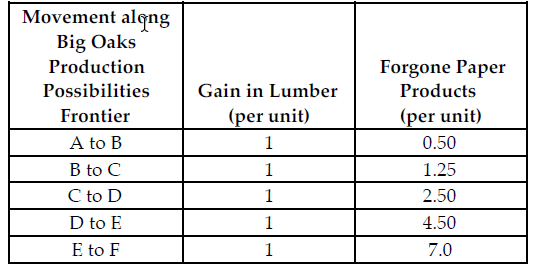

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is the marginal benefit for each unit of lumber produced?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $13.50

B) $16.50

C) $10.50

D) $3.00

Most disagreements among economists stem from normative issues

a. True b. False Indicate whether the statement is true or false