Which of the following explains why the monetary policy implementation lag is relatively short?

I. The FOMC meets several times a year and policymakers are easily able to confer in between meetings.

II. Open market operations, one of the Fed's policy instruments can be put into effect immediately.

III. The Chairman of the Fed works in close collaboration with the President.

IV. Most financial institutions are member banks and will not hesitate to put into effect any new monetary policy.

A) I

B) I and II

C) I, II, and III

D) I, II, III, and IV

Ans: B) I and II

You might also like to view...

Which of the following explains why supply is more elastic as more time passes?

A) It is difficult or impossible to increase the quantity produced in a short period of time. B) Consumers have more time to search for substitutes. C) Sellers try to take advantage of a high price in the short term. D) The supply curve becomes generally steeper as more time passes. E) There is no explanation for this phenomenon.

A technological advance that increases the productivity of all inputs is best illustrated as: a. a movement along the production possibilities curve. b. a flattening of the production possibilities curve

c. an inward shift of the production possibilities curve. d. an outward shift of the production possibilities curve.

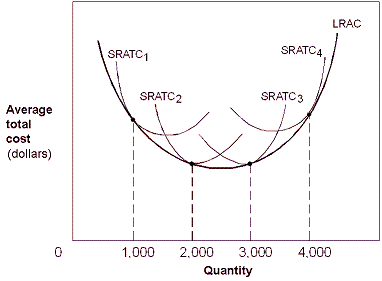

Exhibit 6-14 Cost curves

?

A. Diseconomies of scale; constant returns to scale; economies of scale. B. Constant returns to scale; economies of scale; diseconomies of scale. C. Economies of scale; constant returns to scale; diseconomies of scale. D. Economies of scale; diseconomies of scale; constant returns to scale.

You borrow $10,000 from a bank for one year at a nominal interest rate of 5%. The CPI over that year rises from 180 to 200. What is the real interest rate you are paying?

A) 15% B) 5% C) -1.1% D) -6.1%