Which of the following might increase the supply curve of labor?

a. Easing licensing requirements.

b. Elimination of discrimination against blacks.

c. All of the answers are correct.

d. Elimination of discrimination against females.

c

You might also like to view...

A tax that causes the price that producers receive for a commodity to deviate from the buyer's price is

A. an unit tax. B. a compensated tax. C. an income tax. D. a price-distorting tax.

Social Security is paid for by an earmarked payroll tax

a. True b. False

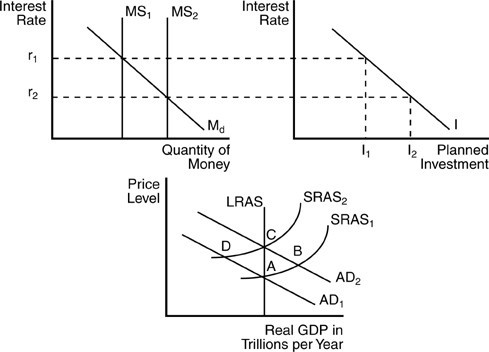

In the above figure, suppose the economy is at a short-run equilibrium at point B and the interest rate is r2. Which of the following policy options for the Fed will help solve the short-run situation?

In the above figure, suppose the economy is at a short-run equilibrium at point B and the interest rate is r2. Which of the following policy options for the Fed will help solve the short-run situation?

A. open market sale of government securities B. open market purchase of government securities C. lowering the required reserve ratio D. lowering the differential between the discount rate and the federal funds rate

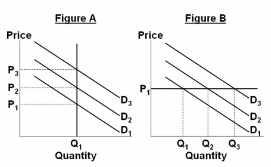

Refer to the figures. If government policy can be used to affect the level of demand in the economy, these figures suggest that government policy:

A. can affect the level of output in the very short run, when prices are stuck.

B. can affect the level of output in the longer run, when prices are flexible.

C. cannot affect output in either the very short run or the longer run.

D. can be used to simultaneously affect the levels of output and prices.