Which of the following statements is correct?

A. The Federal funds rate is derived based on the prime rate

B. The Federal funds rate is the rate banks charge their most creditworthy customers

C. The discount rate is the rate banks charge one another on overnight loans

D. The prime rate involves longer, more risky loans than the Federal funds rate

D. The prime rate involves longer, more risky loans than the Federal funds rate

You might also like to view...

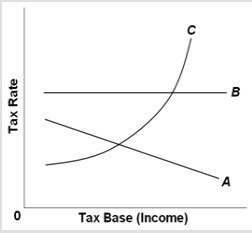

Use the following graph to answer the next question. The relationship between the average tax rate and the tax base in a proportional tax would be represented by

The relationship between the average tax rate and the tax base in a proportional tax would be represented by

A. curve A. B. curve B. C. curve C. D. none of the curves.

The money multiplier _______

A. increases if banks increase their desired reserve ratio B. increases if the currency drain ratio increases C. is 1 if the desired reserve ratio equals the currency drain ratio D. decreases if banks increase their desired reserve ratio

Refer to Figure 4-15. As a result of the tax, is there a loss in consumer surplus?

A) No, because the producer pays the tax. B) No, because the market reaches a new equilibrium C) No, because consumers are charged a lower price to cover their tax burden. D) Yes, because consumers pay a price above the economically efficient price.

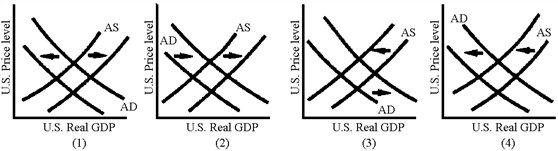

Figure36-8

?

A. 1 B. 2 C. 3 D. 4