If the government removes a $1 tax on sellers of gasoline and imposes the same $1 tax on buyers of gasoline, then the price paid by buyers will

a. increase, and the price received by sellers will increase.

b. increase, and the price received by sellers will not change.

c. not change, and the price received by sellers will increase.

d. not change, and the price received by sellers will not change.

d

You might also like to view...

The case of New Zealand, described in the text, draws what technical conclusion regarding the country's international debt position?

What will be an ideal response?

A high-income household usually is headed by ________ , while a low-income household is usually headed by ________

a. a well-educated working couple; a single parent who is not working b. a highly-educated working female; two middle-aged well-educated adult workers c. a young poorly-educated working male; an old and highly educated male d. a poorly-educated working couple; a well-educated working couple

How is the public debt calculated?

a. By adding up consumption, investment, government purchases, and net exports and then cumulating the annual totals over the years of the nation b. By subtracting consumption and investment from government spending each year and then cumulating the annual totals over the years of the nation c. By subtracting current government spending from current government tax revenues d. By adding up the difference between annual government tax revenues and annual government spending and cumulating the differences over the years of the nation

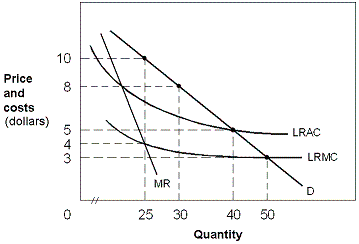

Exhibit 13-3 A monopolist

A. this firm would earn excess profit. B. total revenue would equal marginal revenue. C. the firm would suffer losses. D. revenue would just be sufficient to cover costs.