The time period to replace property destroyed in an involuntary conversion is two years from the event.

Answer the following statement true (T) or false (F)

False

The replacement period ends two years after the close of the first taxable year in which any part of the gain is realized.

You might also like to view...

Which of the following statements about the probing method of obtaining commitment is FALSE?

A. The salesperson should begin by asking directly for a commitment. B. The method is especially effective with Japanese and Arab business prospects. C. This method attempts to bring all pertinent issues into the open. D. After successfully dealing with the prospect's concerns, the sales rep should seek commitment. E. The rep asks a series of questions designed to discover the reason for hesitation.

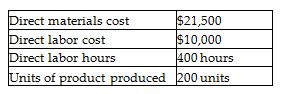

Irene Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, the company estimated total manufacturing overhead costs at $1,020,000 and total direct labor costs at $820,000. In June, Job 711 was completed. The details of Job 711 are shown below.

How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent.)

A) $157.50

B) $197.70

C) $169.70

D) $219.70

Brand ambassadors are volunteers spreading a company's brand message, while brand evangelists are paid employees using potentially unethical marketing tactics to spread a company's brand message

Indicate whether the statement is true or false

An entity that is organized according to state or federal statutes and in which ownership is divided into shares of stock is a

A) proprietorship B) corporation C) partnership D) governmental unit