How much is a bond worth if it pays $20 in coupon payments at the end of each year for 4 years and $1,000 at the end of the fourth year, if the interest rate is 5%?

A) $822.70 B) $893.62 C) $1,070.92 D) $1,080

B

You might also like to view...

Several features distinguish hedge funds from traditional mutual funds, including

A) mutual funds have a minimum investment requirement of $1,000 or more; hedge funds have no minimum investment requirement. B) hedge funds typically charge investors large fees relative to mutual funds. C) hedge fund investors need not commit their money for more than a few weeks at a time, explaining why they pay higher fees. D) hedge funds are significantly less risky relative to mutual funds.

A consulting company estimated market demand and supply in a perfectly competitive industry and obtained the following results:Qd = 25,000 ? 5,000P + 25MQs = 240,000 + 5,000P ? 2,000PI where P is price, M is income, and PI is the price of a key input. The forecasts for the next year are  ? = $15,000 and

? = $15,000 and  I = $20. Average variable cost is estimated to beAVC = 14 ? 0.008Q + 0.000002Q2Total fixed cost will be $6,000 next year. What will the firm's profit (loss) be?

I = $20. Average variable cost is estimated to beAVC = 14 ? 0.008Q + 0.000002Q2Total fixed cost will be $6,000 next year. What will the firm's profit (loss) be?

A. $30,000 B. $36,000 C. $26,000 D. $20,000 E. -$6,000, the firm shuts down and loses only its fixed costs.

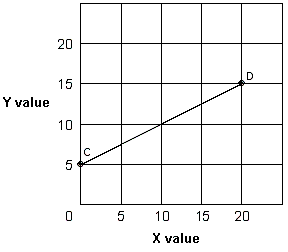

Exhibit 1A-2 Straight line

A. As the X value increases by 20, the Y value increases by 5, so the slope is 4. B. As the Y value increases by 5, the X value increases by 20, so the slope is 1/4. C. As the X value increases by 10, the Y value increases by 5, so the slope is 2. D. As the Y value increases by 5, the X value increases by 10, so the slope is 1/2.

The BCG Matrix defines products or services in high growth markets with high market share as:

Stars Cash Cows Question Marks Dogs