Ryan and Peter share profits in the ratio 3:2. They have decided to liquidate the partnership. The furniture and the equipment were sold at a cumulative loss of $4000. The accounts receivable were collected in full and the other assets were written off as worthless. The accounts payable and other liabilities were paid off at book value. The firm's accountant distributed the remaining cash between Ryan and Peter equally. However, Peter initiated a lawsuit claiming that his share was greater than Ryan's. How much should Peter have received?

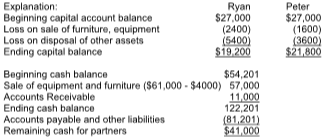

The balance sheet of Ryan and Peter's partnership as of December 31, 2018, is given below.

A) $20,500

B) $19,200

C) $21,800

D) $23,200

C) $21,800

The partners divide the remaining cash according to their capital balances. As a result,

Peter should receive $21,800 cash and Ryan should receive $19,200 cash.

You might also like to view...

Which of the following is most likely to be used for measuring customer satisfaction levels?

A) critical path method B) five point scale C) fishbone diagram D) program evaluation and review technique

Explain the concept of cloud computing and how it benefits organizations that use it.

What will be an ideal response?

Of the three types of barriers that may perpetuate discrimination against traditionally disadvantaged groups, which barrier does anti-discrimination legislation more directly address?

a. Stereotyping b. Exclusion from positions of authority c. Lack of role models d. Limited education opportunities

If a third party is involved in the IT solution, a service-level agreement must be prepared and approved.

Answer the following statement true (T) or false (F)